Modified: May 11, 2018 2:18pm

Created: February 22, 2018 4:35pm

Erie County Comptroller Stefan I. Mychajliw reminds taxpayers that “tax season” is here and free assistance is available for those who need help preparing their tax filings. Income taxes are due Tuesday, April 17th, 2018. Comptroller Mychajliw, a consumer advocate and Erie County’s top fiscal officer, reminds families to do their due diligence to find reputable agencies that provide free assistance in preparing tax returns.

Erie County Comptroller Stefan I. Mychajliw reminds taxpayers that “tax season” is here and free assistance is available for those who need help preparing their tax filings. Income taxes are due Tuesday, April 17th, 2018. Comptroller Mychajliw, a consumer advocate and Erie County’s top fiscal officer, reminds families to do their due diligence to find reputable agencies that provide free assistance in preparing tax returns.

“Filing income taxes can be overwhelming, especially for seniors. For those who need help, there are many free resources available. However, before you provide your information to anybody, be sure they are affiliated with a reputable organization. I have supplied a list of locations throughout Erie County that are backed by AARP, IRS or the New York State Department of Taxation and Finance,” said Comptroller Mychajliw.

“Be on alert for scams. There are always lowlifes out there trying to take advantage of others. The good news is that qualified tax experts are available through these agencies. For many families, they can receive tax help free of charge. My office is committed to protecting taxpayers and is available to help anyone who is unsure where to obtain tax filing assistance.”

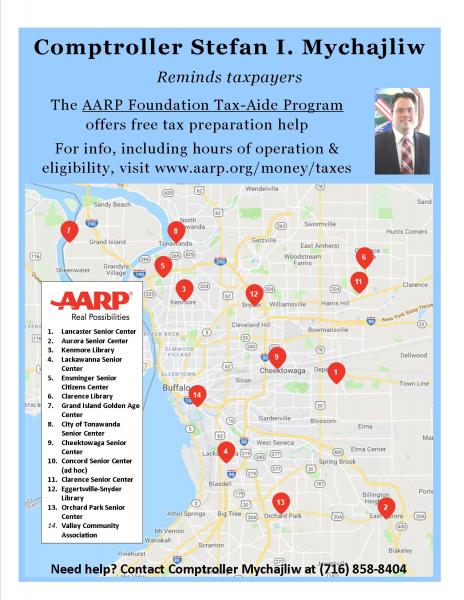

Comptroller Mychajliw adds that the AARP Foundation is hosting 12 Tax-Aide sites throughout Erie County to help residents. Dates and times vary at each location.

AARP’s Tax-Aide sites are as follows:

AARP’s Tax-Aide sites are as follows:

- Aurora Senior Center

- Cheektowaga Senior Center

- City of Tonawanda Senior Center

- Clarence Library

- Clarence Senior Center

- Eggertsville-Snyder Library

- Ensminger Senior Citizens Center

- Kenmore Library

- Lackawanna Senior Center

- Lancaster Senior Center

- Orchard Park Senior Center

- Valley Community Association

Now in its 50th year, Tax-Aide helps low- and moderate-income taxpayers. You do not have to be an AARP member, and there is no age requirement. Call 888-227-7669 or visit www.aarp.org/money/taxes/info-2018/aarp-tax-help-fd.html for additional information.

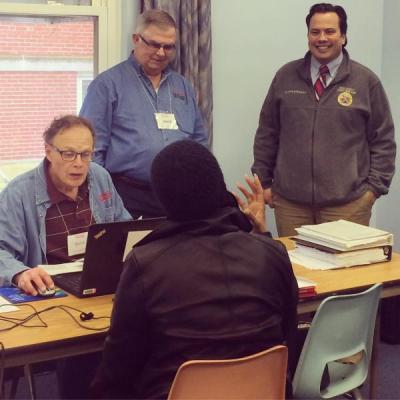

“I stopped by the Eggertsville-Snyder Library during one of AARP’s open sessions. It was extremely busy. The waiting line wrapped around the room. I was pleased to see many taxpayers taking advantage of this free service. The volunteers were doing their best to accommodate everyone waiting. Please be sure you bring all necessary documentation to help ease the process,” added Comptroller Mychajliw.

In addition, the IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax help for taxpayers who qualify.

IRS locations include:

- Daemen College

- SUNY at Buffalo Beta Alpha Psi South, Hayes Hall 403

- CAO of Erie County - Edward Saunders Community Center

- Delavan Grider Community Center

- Buffalo Federation of Neighborhood Centers

- 1199SEIU Upstate – Buffalo

- Frank E. Merriweather Jr. Library

- Northwest Buffalo Community Center

- Belmont Housing Resources for WNY

- SUNY EOC Buffalo

- Riverside Branch Library

- First Shiloh Baptist Church

For information on times and dates and the sites’ addresses, please visit https://irs.treasury.gov/freetaxprep and type in your zip code.

The IRS VITA program is designed for families that make less than $54,000 annually, or for persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. In addition to VITA, the Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

One other option is the Central Library. In partnership with the New York State Department of Taxation and Finance, the Central Library in downtown Buffalo will offer two-hour instructional sessions and assistance on filing federal and state tax forms.

Sessions will be held: Thursday, March 22, Thursday, March 29; Thursday, April 5 and Thursday, April 12. Classes are available at 10:00 a.m. to noon; 1:00 to 3:00 p.m.; and 4:00 to 6:00 p.m. Registration is required. Call 858-8900 to register. Additional information available on the Buffalo and Erie County Public Library's website: 2018 Tax Guides.

Additional information found on the Department of Senior Services' website: Tax Preparation.

Please contact Comptroller Mychajliw’s Office at 858-8404 if you need assistance finding a location.

For a PDF of this Press Release, CLICK HERE.