Together, the towns of Boston, Brant, Collins, Concord, Eden, Evans, North Collins, Orchard Park and Sardinia make up the district I represent in the Erie County Legislature. I represent the largest geographic area made up of 15 towns and villages; however the towns are among the smallest by population and have often felt ignored by the County Executive and his administration.

Together, the towns of Boston, Brant, Collins, Concord, Eden, Evans, North Collins, Orchard Park and Sardinia make up the district I represent in the Erie County Legislature. I represent the largest geographic area made up of 15 towns and villages; however the towns are among the smallest by population and have often felt ignored by the County Executive and his administration.

While I continuously work to bridge the gap between the county departments and the smaller rural towns, there is always more than can be done. This is why I am encouraged by efforts to revise the 1977 Agreement of Sales Tax Revenue Distribution, which determines what portion of the annual sales tax revenue each town, city and school district receives.

The current formula literally shortchanges towns. The issue with the current formula, which was agreed upon in 1977 by the county and the cities of Buffalo, Tonawanda and Lackawanna, is that the population of both towns and cities has changed since that time. Today, only 32 percent of Erie County’s population resides in cities, compared to 46 percent in 1977. Because of this population shift, the policy should change and better reflect today’s demographics.

I want to recognize the town supervisors in my district who have already shown their support for the Fair Share Plan that has been proposed by Assemblyman Ray Walter, candidate for County Executive, and for getting involved in the conversation. We have to work together on this issue if we are going to see all of Erie County prosper.

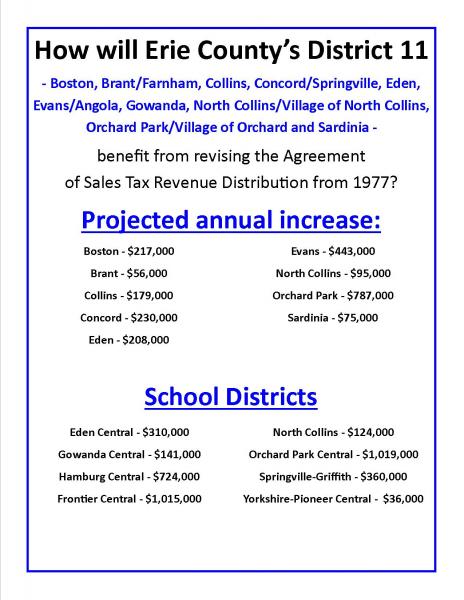

If the proposed Fair Share plan were to be implemented, it would be a boost in revenue for every town in Erie County. The towns in my district would see the following annual increase:

- Boston - $217,000

- Brant - $56,000

- Collins - $179,000

- Concord - $230,000

- Eden - $208,000

- Evans - $443,000

- North Collins - $95,000

- Orchard Park - $787,000

- Sardinia - $75,000

One of the aspects of the Fair Share Plan that is most encouraging is the benefit for suburban school districts. In total, the districts that serve students from my district would see a total increase of $3.73 million that breaks down as such: Eden Central - $310,000; Evans-Brant Central (Lakeshore) - $488,000; Gowanda Central - $141,000; Hamburg Central - $724,000; Frontier Central - $1,015,000; North Collins - $124,000; Orchard Park Central - $1,019,000; Springville-Griffith Institution - $360,000 and Yorkshire-Pioneer Central - $36,000.

Throughout the year I continuously attend town and village board meetings to ensure I am engaged with the municipalities I represent and this proposal is getting a lot of positive response. I look forward to continuing this dialogue as we can’t continue to do business as usual, especially not four decades later. A lot has changed in that time.

If you have any questions or comments about a proposal to reconfigure how sales tax is distributed, please contact my office at 858-8850 or email john.mills@erie.gov.